Difference Between Cost Accounting and Financial Accounting

Introduction: Cost Accounting and Financial Accounting

Suppose you want to understand the financial strength of any company. In that case, you must first understand Cost Accounting and Financial Accounting because both financial and cost accounting plays an important role in understanding the finances of a company. However, both have different functions and are beneficial to different parties. Cost accounting is the field of finance that focuses on the cost of producing the elements of a company. Financial accounting, on the other hand, focuses on fundamental financial reporting that involves the record of an organization’s financial data so that it can show its true financial position.

Cost accounting provides information that helps maintain a record of the activities that are undertaken to increase the company’s revenues and efficiency. Financial accounting is the process of determining figures for the budgetary period, as well as the condition of your holdings, or liabilities as of the day that ends this time. There is no difference because both can be equally advantageous for the consumers. This article will explore the difference between cost accounting and financial accounting, as along with their applications for making decisions and the generation of reports.

What is Cost Accounting?

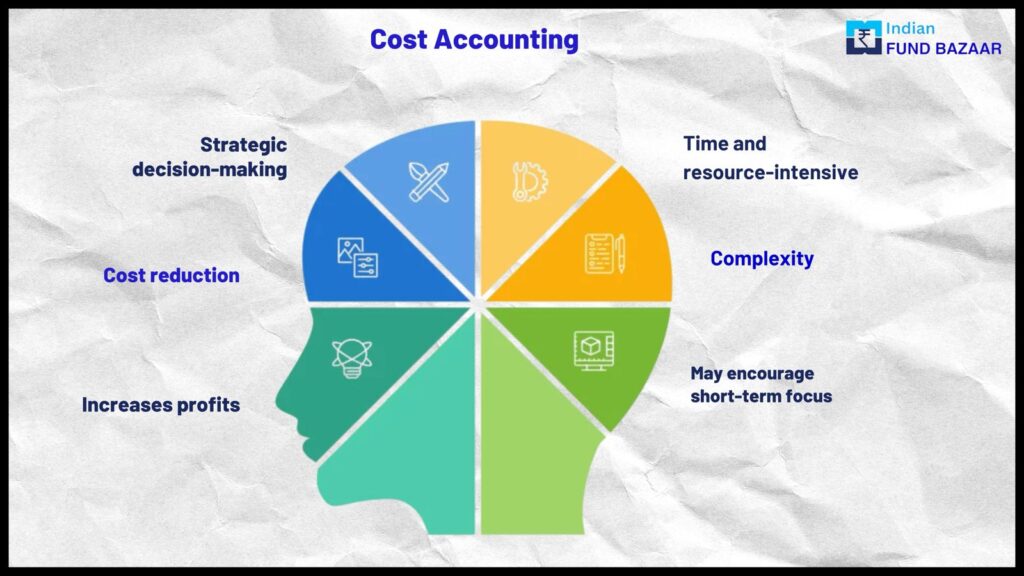

Cost accounting can be described as an intricate blueprint that focuses on specific factors of an organization’s manufacturing costs, which aids management’s decision-making process. Internal management can make well-informed decisions on pricing, budgeting and allocation of resources. Cost accounting gives specific information on service or production expenses that can help guide cost-control actions.

The deep-rooted system feeds on numbers, carefully examining each transaction, resource and cost element to evaluate the cost-efficiency of various business activities.

What is Financial Accounting?

In contrast, it is also an aspect of accounting. It involves keeping track of and summarizing the financial transactions of a particular time. The area of finance accounting concentrates on the production of financial statements which show the results of the business. It focuses on financial statements during a certain time frame and then presents these statements to other stakeholders within the company, such as investors, regulators, and lenders. The basis of financial accounting is standard rules such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Financial statements reflect five categories of data including equity, revenue expenses, assets, and obligations. Assets, liabilities, as well as equity are all reported on the balance sheet which uses financial information to benefit economics for the near future. Income and expenses are listed in the income statement.

Key Differences Between Cost Accounting and Financial Accounting

-

Purpose

- Cost Accounting: It is designed to provide detailed costs to the internal management to make decisions, plan and reduce costs.

- Financial Accounting: It is the process of preparing financial statements for external parties to present a picture of the financial condition of the business.

-

Users

- Cost Accounting: It is primarily utilized by employees including managers as well as department heads.

- Financial Accounting: It is intended for outside stakeholders including investors, shareholders and even government entities.

-

Reporting Frequency

- Cost Accounting: Reports are prepared according to the need, usually either on a weekly or daily schedule.

- Financial Accounting: The reports are usually made on a monthly or annually.

-

Standards

- Cost Accounting: It’s not controlled by any specific rules or regulations and is able to be tailored to meet the specific needs of your company.

- Financial Accounting: It has to be in line with strict standards like GAAP or IFRS in order to ensure consistency and comparability.

-

Focus

- Cost Accounting is a process that focuses on a specific product and/or process in a firm.

- Finance Accounting is a focus on financial performance.

-

Level of Detail

- Cost Accounting: This report provides a detailed cost analysis for costs that are incurred when making or providing services.

- Financial Accounting: This provides a summary of the financial operations of the firm for a particular time.

| Feature | Cost Accounting | Financial Accounting |

| Purpose | Internal management | External reporting |

| Scope | Detailed product costs | Overall financial performance |

| Timeframe | Historical and projected | Historical |

| Users | Managers, executives | Investors, creditors |

| Standards | Not necessarily | Adheres to GAAP or IFRS |

Cost Accounting And Financial Accounting With Examples

Cost Accounting: Manufacturing companies use cost accounting to calculate the price of making an item in one piece, which helps them set a fair selling price.

Financial Accounting: The annual balance sheet as well as its income statements are examples of outputs of financial accounting that are used to present financial results to shareholders.

Difference Between Financial, Cost, and Management Accounting

Apart from financial and cost accounting there is also cost accounting apart from management accounting. The following are the differences between them:

- Financial Accounting: The focus is on reporting the financial results of the company to stakeholders outside.

- Cost Accounting: The emphasis is the tracking of internal production costs as well as assisting the management in controlling expenses.

- Management Accounting: This involves preparing financial records to be used internally by the management for decision-making that includes financial and non-financial indicators.

Difference Between Cost Accounting and Financial Accounting in Points

Objective:

- Cost Accounting: to estimate and monitor the costs.

- Finance Accounting: to communicate the financial health of an organization to other stakeholders.

Reporting Audience:

- Cost Accounting: internal Management.

- Finance Accounting: External Parties (shareholders and regulatory authorities).

Time Frame:

- Cost Accounting: Continually often created reports.

- Financial Accounting: Monthly reports (quarterly or annual).

Regulation:

- Cost Accounting: There are no specific rules.

- Financial Accounting: Governed by GAAP, IFRS.

Detail Level:

- Cost Accounting: In-depth cost-related details.

- Financial Accounting: A summary of the financial performance.

FAQs about Cost Accounting & Financial Accounting

1. What is the distinction between financial and cost accounting?

The main difference between financial and cost accounting lies in their goals and the reporting style. Cost accounting is focused on the management of costs within an organization for operational decision-making, and financial accounting reports its financial status to external parties, like investors. Both follow standardized rules.

2. What’s the distinction between cost accounting?

Financial accounting provides a breakdown of the financial performance of external entities, like regulators and investors, using accepted standards like GAAP. In contrast to cost accounting, it is more focused on internal control to measure the processes, and manage, and decrease costs associated with the manufacture or delivery of services.

Conclusion: Cost Accounting and Financial Accounting

The data provided through Cost Accounting would be useful to management in making decisions and controlling costs, but there is no consistency. Knowing these accounting formats is not just the need for bureaucratic processes. They form the foundation of a company’s financial structure that influences the decisions made on every level and within every department. If they are properly understood and utilized it can turn into an effective tool in any organisation’s arsenal. Information provided by financial accounting may be used to create comparisons, however it is not able to be employed to predict accurately.

The two types of accounting are the yin and Yang in finance for business and can balance internal efficiency with external conformity. Knowing and using them effectively can be like harnessing the strength of two languages in telling an accurate and complete narrative of an organization’s financial condition. These two systems are in sync as well. In reality, the cost accounting data helps in accounting for finance.

By understanding the difference between cost accounting and financial accounting, businesses can make more informed decisions, optimize their operations, and achieve long-term success.

Indian Fund Bazaar